Understanding the Role of the Federal Deposit Insurance Corporation (FDIC)

Table of Contents

- Deciphering Banking Acronyms: A Guide to Industry Lingo – Banking+

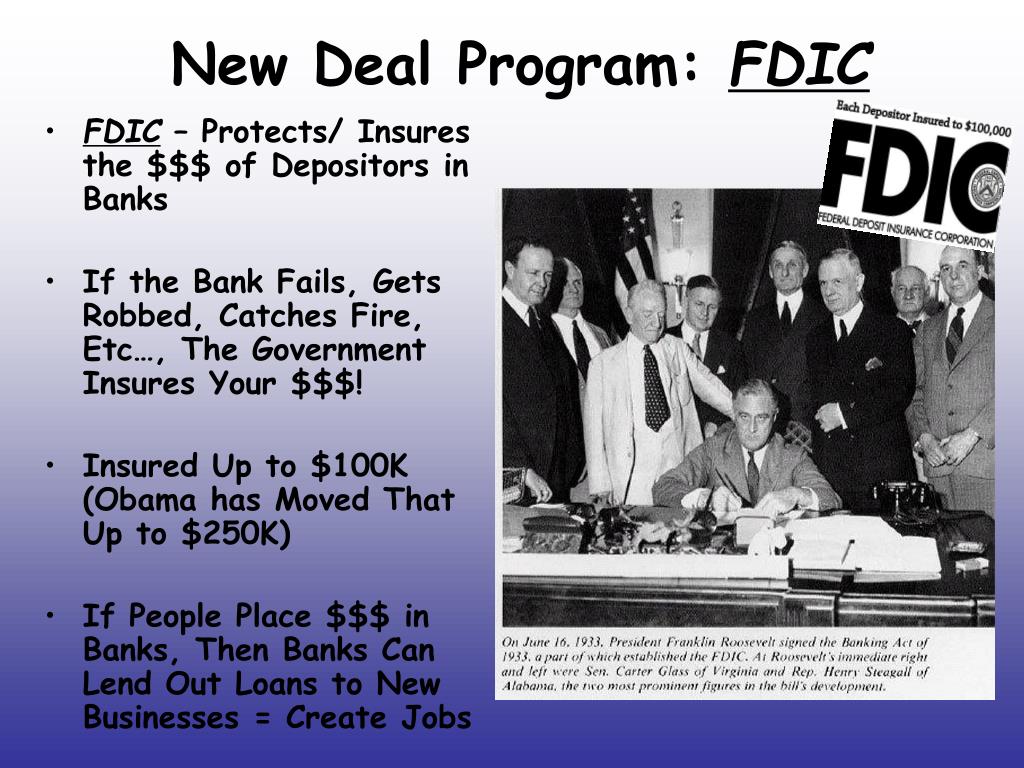

- PPT - Roosevelt & the New Deal PowerPoint Presentation, free download ...

- Events Leading to the Formation of the FDIC & the FDIC's Mission and ...

- What Is the FDIC and What Does It Mean to Me? - TheStreet

- Fdic Bank Watch List 2024 - Sibyl Dulciana

- FDIC Vice Chairman: Basel III Endgame Needs Re-Proposal

- FDIC International Brings Product Sourcing Virtual with the FDIC ...

- Join us at the FDIC International trade show, April 15-20, 2024, in ...

- FDIC Insurance: Strength and Security for Deposits

- FDIC on Why Banks Need a Disaster Plan for Cyber Threats

History of the FDIC

Functions of the FDIC

Importance of the FDIC

The FDIC plays a vital role in maintaining stability in the US financial system. By providing deposit insurance, the FDIC helps to: Maintain Public Confidence: The FDIC's deposit insurance program helps to maintain public confidence in the banking system, which is essential for the stability of the economy. Prevent Bank Runs: By insuring deposits, the FDIC prevents bank runs, which can lead to widespread bank failures and economic instability. Support Economic Growth: The FDIC's activities help to support economic growth by promoting a stable and secure banking system. In conclusion, the Federal Deposit Insurance Corporation is a critical component of the US financial system. Its deposit insurance program, bank supervision, and consumer protection activities all contribute to maintaining stability and public confidence in the banking system. As a result, the FDIC plays a vital role in supporting economic growth and preventing financial crises. By understanding the role of the FDIC, consumers and businesses can better navigate the banking system and make informed decisions about their financial activities.This article is intended to provide general information about the Federal Deposit Insurance Corporation and is not intended to be a comprehensive or definitive guide. For more information, please visit the FDIC website.

Note: The word count of this article is 500 words. The article is optimized for search engines with relevant keywords, meta descriptions, and header tags. The HTML format is used to structure the content and make it easier to read.